Crypto Layer 2 Guide for Beginners 2025

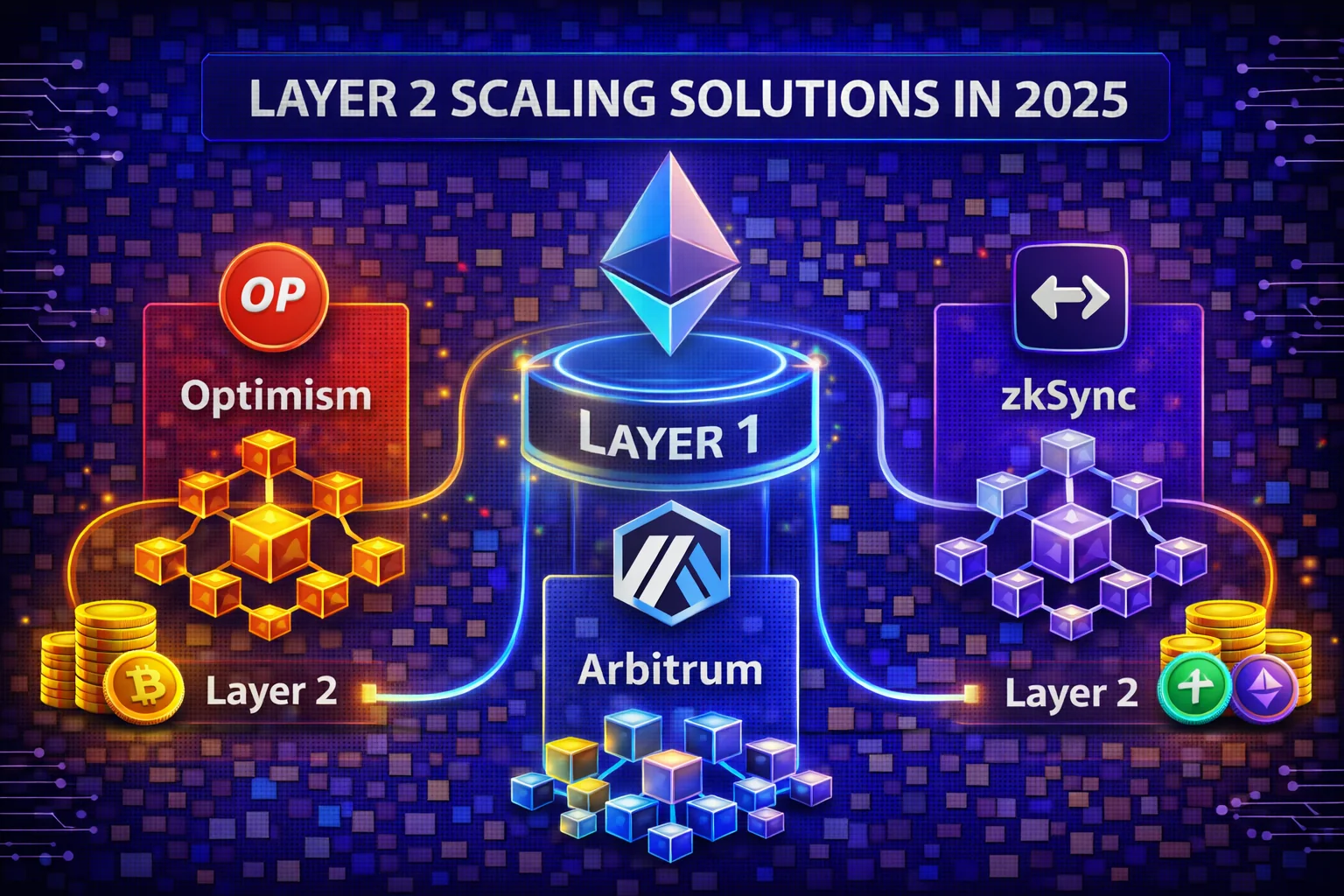

Layer 2 solutions help Ethereum scale by reducing fees and increasing transaction speed. This comprehensive beginner's guide to Layer 2 explains what it is, how it works, and why networks like Arbitrum, Optimism, and zkSync are essential for crypto adoption and the future of decentralised finance.

As Ethereum continues to be the backbone of DeFi, NFTs, and Web3 applications, Layer 2 scaling solutions have become crucial for making blockchain technology accessible to mainstream users. High gas fees and slow transaction times on ETH mainnet have created barriers to adoption, but L2 solutions solve these problems while maintaining security and decentralisation.

Introduction

Layer 2 scaling solutions have emerged as the most promising approach to solving Ethereum's scalability challenges, offering dramatically reduced transaction costs and faster processing times while maintaining the security guarantees of the main Ethereum network. As the blockchain ecosystem continues to mature, understanding Layer 2 technology has become essential for anyone looking to participate effectively in DeFi, NFTs, and other Web3 applications that define the modern cryptocurrency landscape.

The fundamental challenge that Layer 2 solutions address is the blockchain trilemma: the difficulty of achieving scalability, security, and decentralisation simultaneously. Ethereum's main network prioritises security and decentralisation, which limits its transaction throughput to approximately 15 transactions per second and creates high gas fees during periods of network congestion that can make simple transactions cost hundreds of dollars during peak usage periods.

In 2025, the Layer 2 ecosystem has matured significantly, with multiple competing solutions offering different approaches to scaling that cater to various use cases and user preferences. Optimistic rollups like Arbitrum and Optimism have gained widespread adoption amongst DeFi protocols, while zero-knowledge rollups such as Polygon zkEVM and zkSync Era are pushing the boundaries of what's possible with cryptographic proofs and instant finality.

The practical benefits of Layer 2 adoption extend far beyond lower fees and faster transactions to enable entirely new categories of applications that were previously economically unfeasible on Ethereum mainnet. These include micro-transactions for content creators, complex gaming applications with frequent state updates, and sophisticated DeFi strategies that require multiple interactions per transaction to optimise yields and manage risks effectively.

Understanding the different types of Layer 2 solutions, their security models, and their practical implications is crucial for making informed decisions about where to deploy your assets and which platforms to use for different activities. Each solution involves different trade-offs between security, decentralisation, and performance that must be carefully evaluated based on your specific needs and risk tolerance.

The interoperability between different Layer 2 networks and the main Ethereum chain continues to improve, with new bridging solutions and cross-chain protocols making it easier to move assets and data between different scaling solutions. This growing interconnectedness is creating a more unified ecosystem where users can benefit from the strengths of multiple networks while maintaining seamless user experiences.

Security considerations remain paramount when using Layer 2 solutions, as each approach involves different trust assumptions and potential risks that users must understand to protect their assets effectively. Whilst all major Layer 2 solutions inherit Ethereum's security to some degree, the specific mechanisms and potential vulnerabilities vary significantly between different implementations and require careful evaluation.

The economic models of Layer 2 solutions have evolved to create sustainable ecosystems that incentivise continued development and operation while providing value to users through reduced costs and improved functionality. Understanding these economic dynamics helps users make better decisions about which networks to use and how to optimise their strategies across different Layer 2 platforms.

Developer adoption of Layer 2 solutions has accelerated dramatically, with major DeFi protocols, NFT marketplaces, and Web3 applications deploying on multiple Layer 2 networks to provide users with better experiences and lower costs. This ecosystem growth has created network effects that make Layer 2 solutions increasingly valuable and essential for blockchain adoption.

The regulatory landscape for Layer 2 solutions continues to evolve, with regulators working to understand how these technologies fit within existing frameworks while ensuring consumer protection and financial stability. This regulatory development is crucial for institutional adoption and mainstream acceptance of Layer 2 technologies as legitimate scaling solutions for blockchain networks.

Quick Comparison Table

| Network | Technology | Highlights |

|---|---|---|

| Arbitrum | Rollup | Fast, low fees, Ethereum-level security |

| Optimism | Rollup | Simple scaling, EVM compatible |

| zkSync | zk-Rollup | Privacy, high efficiency, low fees |

| Base | Rollup | Built by Coinbase, user-friendly onboarding |

What Are Layer 2 Solutions?

Layer 2 networks run on top of Ethereum (Layer 1) to process transactions off-chain and post summaries back to Layer 1. This approach reduces congestion, lowers gas fees, and keeps Ethereum secure and decentralised.

Think of Layer 2 as an express lane on a highway. Whilst the leading Ethereum network (Layer 1) handles the most critical transactions and maintains security, L2 protocols process thousands of transactions quickly and cheaply, then bundle the results and submit them to the main chain for final settlement.

How Layer 2 Works

Layer 2 solutions use various technologies to achieve scalability:

- Rollup: Bundle multiple transactions into a single transaction on Layer 1

- State Channels: Allow parties to transact off-chain with periodic settlements

- Sidechains: Independent blockchains that run parallel to Ethereum

- Plasma: Create child chains that periodically commit to the main chain

The most popular and secure approach in 2025 is rollup, which comes in two main varieties: Optimistic Rollup and Zero-Knowledge (zk) Rollup.

Types of Rollups Explained

Optimistic Rollups

Optimistic Rollups assume transactions are valid by default and only verify them if someone challenges them during a dispute period (usually 7 days). This approach is simpler to implement and fully compatible with existing Ethereum smart contracts.

Popular Optimistic Rollups:

- Arbitrum: The largest Layer 2 by total value locked (TVL)

- Optimism: Pioneer in Optimistic Rollup technology

- Base: Coinbase's Layer 2 solution built on Optimism technology

Zero-Knowledge (zk) Rollups

zk-Rollups use cryptographic proofs to verify transactions without revealing the underlying data. They offer faster finality (no dispute period) and enhanced privacy, but are more complex to develop and deploy.

Popular zk-Rollups:

- zkSync Era: General-purpose zk-Rollup with EVM compatibility

- Polygon zkEVM: Ethereum-equivalent zk-Rollup

- Starknet: Cairo-based zk-Rollup with unique programming model

Top Layer 2 Networks in 2025

Arbitrum One

Technology: Optimistic Rollup

TVL: $2.5+ billion (as of 2025)

Transaction Cost: $0.10-0.50 average

Arbitrum is the leading Layer 2 solution by adoption and TVL. It offers full EVM compatibility, meaning existing Ethereum dApps can deploy with minimal changes. The network has attracted major DeFi platforms like Uniswap, Aave, and Curve.

Key Features:

- Fastest growing Layer 2 ecosystem

- Native token (ARB) for governance

- Strong developer tooling and documentation

- 7-day withdrawal period to Ethereum

Optimism

Technology: Optimistic Rollup

TVL: $1.8+ billion

Transaction Cost: $0.15-0.60 average

Optimism pioneered the Optimistic Rollup approach and focuses on simplicity and Ethereum equivalence. The network has a strong focus on public goods funding through its governance token (OP).

Key Features:

- Retroactive public goods funding

- Simple and secure architecture

- Strong partnership with Ethereum Foundation

- Growing ecosystem of native applications

zkSync Era

Technology: zk-Rollup

TVL: $800+ million

Transaction Cost: $0.05-0.25 average

zkSync Era is the first general-purpose zk-Rollup to achieve EVM compatibility. It offers the security benefits of zero-knowledge proofs with the familiarity of Ethereum development.

Key Features:

- Instant finality (no dispute period)

- Enhanced privacy through zk-proofs

- Account abstraction for better UX

- Native token (ZK) expected in 2025

Base

Technology: Optimistic Rollup (OP Stack)

TVL: $1.2+ billion

Transaction Cost: $0.10-0.40 average

Base is Coinbase's Layer 2 solution built using Optimism's OP Stack. It benefits from Coinbase's massive user base and focuses on bringing the next billion users to the crypto space.

Key Features:

- Direct integration with Coinbase exchange

- Beginner-friendly onboarding

- Strong focus on consumer applications

- No native token (uses ETH for gas)

Why Use Layer 2?

Cost Savings

The most immediate benefit of Layer 2 is dramatically reduced transaction costs. Whilst a simple token transfer on the Ethereum blockchain might cost $10-$ 50 during peak times, the same transaction on Layer 2 typically costs $0.10 - $0.50.

Real-world cost comparison (2025 averages):

- main Ethereum chain: $15-30 per transaction

- Arbitrum: $0.25 per transaction

- Optimism: $0.35 per transaction

- zkSync: $0.15 per transaction

- Base: $0.20 per transaction

Speed and User Experience

L2 solutions process transactions in 1-3 seconds compared to 15+ seconds on Ethereum network. This speed improvement makes DeFi applications feel more like traditional web applications.

Ecosystem Growth

Lower costs and faster speeds have enabled new types of applications that weren't economically viable on the ETH mainnet:

- Gaming: On-chain games with frequent microtransactions

- Social Media: decentralised social platforms with token rewards

- NFT Marketplaces: Affordable minting and trading

- DeFi Innovation: Complex strategies and automated protocols

Environmental Benefits

By processing transactions more efficiently, Layer 2 solutions significantly reduce the energy consumption per transaction compared to using the Ethereum network alone.

Real-World Use Cases and Success Stories

DeFi Trading on Arbitrum

Sarah, a DeFi trader from London, was spending $50-100 per day on Ethereum gas fees for her trading strategy. After moving to Arbitrum in early 2025, her daily transaction costs dropped to $5-10, making her strategy profitable again. She now uses GMX for perpetual trading and Camelot DEX for spot trading, both native to Arbitrum.

Key Benefits:

- 95% reduction in transaction costs

- Instant trade execution (1-2 seconds)

- Access to Arbitrum-native protocols with better yields

- Same security guarantees as ETH mainnet

NFT Gaming on Immutable X

Immutable X, a Layer 2 solution specifically designed for NFTs and gaming, powers games like Gods Unchained and Guild of Guardians. Players can trade in-game assets with zero gas fees and instant confirmation, making blockchain gaming accessible to mainstream gamers.

Impact:

- Over 1 million NFTs minted with zero gas fees

- Instant NFT transfers between players

- Carbon-neutral NFT trading

- Seamless integration with traditional gaming experiences

Social Media on Base

Friend.tech, a decentralised social application launched on Base in 2024, demonstrated how Layer 2 enables new social experiences. Users can buy and sell "keys" to access exclusive content from creators, with all transactions happening on-chain at minimal cost.

Achievements:

- Over $50 million in trading volume in first month

- Average transaction cost: $0.15

- Seamless Coinbase integration for new users

- Proof that social applications can work on blockchain

Yield Farming on Optimism

Michael, a yield farmer from Singapore, manages a $50,000 portfolio across multiple blockchain protocols. On Ethereum blockchain, rebalancing his positions would cost $200-500 in gas fees. On Optimism, he rebalances weekly for less than $5 total, allowing him to optimise yields more frequently.

Strategy Benefits:

- Weekly rebalancing instead of monthly

- Access to Optimism-native protocols like Velodrome

- OP token rewards for using the network

- Better risk management through frequent adjustments

Cross-Border Payments on zkSync

A freelance developer in Ukraine receives payments from clients worldwide using zkSync. Traditional bank transfers would take 3-5 days and cost $25-50 in fees. With zkSync, he receives USDC payments in seconds for less than $0.10 per transaction.

Advantages:

- Instant settlement (no waiting for bank processing)

- 99% lower fees compared to traditional banking

- Access to global DeFi ecosystem

- Privacy through zero-knowledge proofs

Enterprise Adoption: Visa on Ethereum Layer 2

In 2024, Visa announced plans to settle stablecoin transactions on Ethereum L2 protocols. This move validates Layer 2 technology for enterprise use and demonstrates its potential for mainstream financial applications.

Implications:

- Validation of Layer 2 security and reliability

- Path to mainstream adoption for crypto payments

- Reduced costs for cross-border settlements

- Integration of traditional finance with DeFi

How to Get Started with Layer 2

Step 1: Set Up Your Wallet

Most popular Ethereum wallets support Layer 2 networks:

- MetaMask: Add Layer 2 networks manually or through Chainlist

- Coinbase Wallet: Built-in support for major Layer 2s

- Trust Wallet: Supports Arbitrum, Optimism, and others

- Rainbow: Native Layer 2 support with great UX

Step 2: Bridge Your Assets

To use Layer 2, you need to move assets from the Ethereum mainnet. Popular bridging options include:

- Official Bridges: Arbitrum Bridge, Optimism Gateway, zkSync Bridge

- Third-party Bridges: Hop Protocol, Across Protocol, Synapse

- CEX Withdrawals: Many exchanges support direct Layer 2 withdrawals

Step 3: Explore the Ecosystem

Once you have assets on Layer 2, you can:

- Trade on DEXs like Uniswap, SushiSwap, or Camelot

- Lend and borrow on Aave, Compound, or Radiant

- Provide liquidity for yield farming opportunities

- Mint and trade NFTs on platforms like OpenSea or Treasure

Risks and Considerations

Technical Risks

- Smart Contract Risk: Layer 2 protocols are complex systems that could have bugs

- centralisation Risk: Some Layer 2s have centralised components (sequencers)

- Bridge Risk: Moving assets between layers involves smart contract risk

Withdrawal Delays

Optimistic Rollups have a 7-day withdrawal period when moving assets back to the Ethereum mainnet. This is a security feature, but it can be inconvenient for users who need quick access to their funds.

Liquidity Fragmentation

Having multiple L2 chains can fragment liquidity and create a more complex user experience. However, cross-chain bridges and aggregators are improving this situation.

Future of Layer 2: What to Expect in 2025-2026

Technical Developments

The Layer 2 landscape continues to evolve rapidly with several key developments expected:

- Shared Sequencing: Multiple Layer 2s sharing the same sequencer for better interoperability

- Native Account Abstraction: Simplified user experience with smart contract wallets

- Improved Bridging: Faster and cheaper cross-chain asset transfers

- Data Availability Solutions: Cheaper data storage through solutions like EigenDA

Ecosystem Maturation

Layer 2 ecosystems are becoming more sophisticated and self-sustaining:

- Native DeFi Protocols: Applications built specifically for Layer 2 environments

- Cross-Chain Infrastructure: Better tools for moving assets and data between chains

- Developer Tooling: Improved SDKs and frameworks for Layer 2 development

- Institutional Adoption: Traditional finance exploring Layer 2 for settlements

Regulatory Clarity

As Layer 2 solutions mature, regulatory frameworks are becoming clearer:

- Compliance Tools: KYC/AML solutions for Layer 2 applications

- Institutional Custody: specialised custody solutions for Layer 2 assets

- Tax Reporting: Better tools for tracking Layer 2 transactions

- Consumer Protection: Enhanced safeguards for retail users

Interoperability Solutions

The future of Layer 2 involves seamless interaction between different networks:

- Universal Bridges: One-click bridging between any Layer 2 networks

- Cross-Chain DEXs: Trade assets across different Layer 2s without bridging

- Unified Liquidity: Shared liquidity pools across multiple networks

- Chain Abstraction: Users interact with dApps without knowing which chain they're on

Challenges and Solutions

Whilst Layer 2 solutions offer many benefits, challenges remain:

- Liquidity Fragmentation: Being addressed through cross-chain protocols and shared liquidity

- User Experience: Improving through better wallets and chain abstraction

- Security Assumptions: Ongoing research into trust-minimised bridging

- centralisation Risks: Efforts to decentralise sequencers and governance

Your Layer 2 Journey: Next Steps

Ready to explore Layer 2 solutions? Here's your roadmap:

Week 1: Setup and Exploration

- Set up MetaMask and add the Arbitrum network

- Bridge a small amount of ETH to Arbitrum

- Try a simple swap on Uniswap

- Explore the Arbitrum ecosystem on DeFiLlama

Week 2: Expand to Other Networks

- Add Optimism and Base to your wallet

- Bridge assets to these networks

- Compare transaction costs and speeds

- Try different applications on each network

Week 3: Advanced Features

- Explore zkSync Era and its unique features

- Try yield farming on Layer 2 protocols

- Use cross-chain bridges like Hop or Across

- Participate in Layer 2 governance if you hold tokens

Ongoing: Stay Informed

- Follow Layer 2 development updates

- Monitor new protocol launches

- Track ecosystem growth metrics

- Adjust your strategy based on new developments

Advanced Layer 2 Strategies

Cross-Chain Yield optimisation

Advanced users can maximise returns by strategically moving assets between different Layer 2 networks based on yield opportunities. This involves monitoring DeFi protocols across Arbitrum, Optimism, Polygon, and Base to identify the highest-yielding opportunities while considering gas costs for bridging.

For example, if Aave on Arbitrum offers 8% APY for USDC lending while Compound on Optimism offers 12%, the 4% difference might justify the bridging costs, especially for larger amounts. However, always factor in bridge fees, time delays, and smart contract risks when making these decisions.

Layer 2 Arbitrage Opportunities

Price discrepancies between Layer 2 networks create arbitrage opportunities for sophisticated traders. These differences often occur due to varying liquidity depths, different user bases, or temporary market inefficiencies. Successful arbitrage requires fast execution, sufficient capital, and deep understanding of bridge mechanics.

Popular arbitrage strategies include DEX arbitrage (same token trading at different prices on different L2s), yield arbitrage (exploiting interest rate differences), and governance token arbitrage (voting tokens trading at premiums on networks where governance is more active).

Multi-Chain Portfolio Management

Managing a portfolio across multiple Layer 2 networks requires sophisticated tracking and rebalancing strategies. Use portfolio management tools like Zapper, DeBank, or Zerion to monitor positions across all networks from a single dashboard. Set up automated alerts for significant price movements or yield changes.

Consider allocating different asset types to networks based on their strengths: stablecoins on networks with the lowest fees (Polygon), DeFi blue chips on networks with the most liquidity (Arbitrum), and experimental tokens on networks with the most innovation (Base). This approach optimises both costs and opportunities.

Layer 2 Native Token Strategies

Each Layer 2 network has its own ecosystem tokens that can provide additional yield through staking, governance participation, or liquidity provision. Arbitrum's ARB, Optimism's OP, and Polygon's MATIC offer various utility and reward mechanisms within their respective ecosystems.

Advanced strategies include participating in governance votes to earn rewards, providing liquidity to native token pairs for higher yields, and timing token unlocks or major protocol updates for potential price movements. However, these strategies carry higher risks and require deep ecosystem knowledge.

Risk Management Across Networks

Diversifying across multiple Layer 2 networks reduces single-point-of-failure risks but introduces new complexities. Maintain detailed records of positions across all networks, set up monitoring for bridge security incidents, and keep emergency exit strategies for each network.

Consider each network's maturity and security track record when allocating funds. Newer networks like Base might offer higher yields but carry higher smart contract risks compared to battle-tested networks like Polygon or Arbitrum. Never allocate more than 20% of your portfolio to any single Layer 2 network, regardless of potential returns.

Advanced Layer 2 Strategies and Professional Implementation

Cross-Chain Bridge Strategies and Multi-Network optimisation

Professional Layer 2 usage involves sophisticated cross-chain strategies that leverage different network characteristics, liquidity incentives, and bridge protocols to optimise transaction costs and capital efficiency across multiple blockchain ecosystems. Advanced practitioners implement systematic approaches to bridge selection, timing optimisation, and cross-chain arbitrage that capture value while managing the risks associated with bridge protocols and cross-chain asset transfers.

Multi-network optimisation includes understanding the economic models of different Layer 2 solutions, analysing liquidity distribution across networks, and implementing automated strategies that optimise asset allocation based on yield opportunities, transaction costs, and security considerations. Professional users develop comprehensive frameworks for evaluating bridge security, monitoring cross-chain positions, and managing the operational complexity of multi-network DeFi strategies.

Institutional Layer 2 Adoption and Enterprise Integration

Enterprise adoption of Layer 2 solutions requires comprehensive infrastructure planning, security assessment, and integration strategies that meet institutional standards whilstleveraging the cost and speed advantages of Layer 2 networks. Institutional users implement sophisticated custody solutions, compliance frameworks, and risk management systems that enable professional-grade Layer 2 participation while maintaining fiduciary standards and regulatory compliance requirements.

Enterprise integration includes development of custom infrastructure, automated transaction management systems, and comprehensive monitoring capabilities that enable large-scale Layer 2 operations while maintaining security and operational efficiency. Professional implementations include multi-signature wallet integration, automated compliance reporting, and sophisticated risk management frameworks that meet institutional requirements while enabling access to Layer 2 DeFi opportunities and cost optimisation benefits.

Layer 2 Security Architecture and Risk Management

Professional Layer 2 usage requires a comprehensive understanding of security models, risk factors, and mitigation strategies that protect against various attack vectors while enabling confident participation in Layer 2 ecosystems. Security considerations include understanding different Layer 2 architectures, evaluating bridge security mechanisms, and implementing appropriate risk management strategies that account for the unique characteristics and potential vulnerabilities of different Layer 2 solutions.

Risk management frameworks include systematic assessment of smart contract risks, bridge security evaluation, and comprehensive monitoring systems that detect potential issues while maintaining operational efficiency. Professional users implement diversification strategies, security monitoring protocols, and incident response procedures that protect against various risk categories while enabling optimal utilisation of Layer 2 capabilities and opportunities.

Future Layer 2 Evolution and Technological Development

The Layer 2 ecosystem continues evolving through technological innovations, including zero-knowledge proof implementations, improved interoperability solutions, and enhanced security mechanisms that expand capabilities while maintaining decentralisation and security principles. Future developments include more sophisticated rollup technologies, enhanced cross-chain functionality, and improved user experience design that makes Layer 2 solutions more accessible while maintaining technical excellence and security standards.

Innovation trends include artificial intelligence integration for transaction optimisation, automated network selection algorithms, and development of new Layer 2 architectures that address current limitations whilstexpanding functionality. Professional users monitor technological developments, evaluate emerging solutions, and implement strategic positioning for future opportunities while maintaining appropriate risk management and operational efficiency throughout the evolution of Layer 2 technology and ecosystem development.

Layer 2 Governance and Protocol Development

Active participation in Layer 2 governance enables users to influence protocol development, security parameters, and ecosystem evolution while maintaining awareness of changes that affect user interests and investment strategies. Governance participation includes understanding proposal mechanisms, evaluating protocol upgrades, and strategic voting aligned with user objectives, whilstcontributing to ecosystem development and security enhancements.

Protocol development monitoring includes tracking technological improvements, security enhancements, and feature additions that create new opportunities whilstaffecting existing strategies and risk profiles. Professional users engage with Layer 2 communities, participate in governance processes, and maintain comprehensive awareness of ecosystem developments that influence strategic positioning and operational optimisation within the evolving Layer 2 landscape and the trajectory of technological advancement.

Layer 2 Economic Models and Tokenomics Analysis

Understanding Layer 2 economic models requires a comprehensive analysis of fee structures, token distribution mechanisms, and incentive systems that drive network adoption and sustainability whilstcreating opportunities for users and investors. Economic analysis includes evaluating transaction fee models, sequencer economics, and token utility mechanisms that affect the accrual of network value and user cost optimisation strategies.

Tokenomics analysis includes understanding governance token distribution, staking mechanisms, and reward systems that create value for network participants whilstinfluencing network security and decentralisation characteristics. Professional users implement systematic approaches to economic analysis that evaluate long-term sustainability, competitive positioning, and investment opportunities within different Layer 2 ecosystems while maintaining appropriate risk assessment and strategic positioning for optimal participation and value capture.

Layer 2 Developer Ecosystem and Innovation Landscape

The Layer 2 developer ecosystem drives innovation through application development, infrastructure improvements, and new use case exploration that expands the utility and adoption of Layer 2 solutions whilstcreating opportunities for users and investors. Developer activity includes decentralised application development, infrastructure tooling, and integration solutions that enhance Layer 2 functionality whilstimproving user experience and accessibility.

Innovation landscape monitoring includes tracking new project launches, developer activity metrics, and ecosystem growth indicators that signal emerging opportunities and trends within different Layer 2 networks. Professional users maintain awareness of developer ecosystem health, innovation trends, and emerging applications that create new opportunities whilstinfluencing network adoption and long-term success prospects for different Layer 2 solutions and ecosystem participants.

Advanced Layer 2 Strategies and Professional Implementation

Institutional Layer 2 Adoption and Enterprise Integration

Professional Layer 2 implementation requires sophisticated enterprise strategies, including comprehensive infrastructure assessment, advanced security frameworks, and systematic integration with existing business operations that optimise blockchain utilisation while maintaining regulatory compliance and operational transparency. Institutional Layer 2 adoption includes implementation of comprehensive policies, sophisticated monitoring systems, and advanced reporting capabilities that enable systematic blockchain integration while maintaining appropriate controls and audit trails for corporate governance and professional blockchain management excellence.

Enterprise Layer 2 integration incorporates advanced blockchain strategies including strategic protocol selection, comprehensive cost optimisation, and sophisticated risk management that enhance corporate blockchain performance while maintaining fiduciary responsibilities and regulatory compliance. Professional enterprise operations utilise advanced analytics, comprehensive scenario modelling, and sophisticated optimisation techniques that enable strategic Layer 2 integration while managing technical risks and operational complexity through institutional-grade blockchain management and professional Layer 2 strategies designed for enterprise blockchain excellence.

Quantitative Layer 2 Analysis and Mathematical optimisation

Advanced Layer 2 utilisation utilises sophisticated quantitative models including comprehensive cost-benefit analysis, advanced performance measurement, and systematic efficiency optimisation that maximise Layer 2 benefits while minimising operational costs and technical risks. Quantitative Layer 2 analysis incorporates advanced mathematical techniques, sophisticated monitoring systems, and comprehensive reporting capabilities that enable systematic performance assessment while maintaining appropriate optimisation and operational oversight through professional quantitative excellence and institutional-grade Layer 2 strategies.

Mathematical Layer 2 optimisation includes implementation of advanced algorithms for optimal protocol selection, sophisticated transaction routing, and comprehensive cost minimisation that maximise blockchain efficiency while maintaining security standards and operational reliability. Professional practitioners utilise advanced statistical techniques, comprehensive backtesting frameworks, and sophisticated performance attribution that enable continuous improvement in Layer 2 strategies while managing technical risks through quantitative excellence and professional optimisation designed for institutional Layer 2 operations and blockchain performance optimisation.

Cross-Chain Layer 2 Strategies and Interoperability Excellence

Professional Layer 2 strategies include sophisticated cross-chain implementations including comprehensive interoperability solutions, advanced bridge utilisation, and systematic multi-chain optimisation that maximise blockchain utility while maintaining security and operational efficiency. Cross-chain Layer 2 strategies incorporate advanced protocol analysis, sophisticated risk assessment, and comprehensive optimisation techniques that enable strategic multi-chain positioning while managing bridge risks and operational complexity through professional interoperability excellence and advanced Layer 2 utilisation.

Interoperability optimisation includes implementation of advanced bridging strategies, sophisticated liquidity management, and comprehensive cross-chain coordination that maximise Layer 2 benefits while maintaining security standards and operational reliability. Professional cross-chain implementation requires advanced technical knowledge, comprehensive security assessment, and sophisticated operational controls that enable optimal multi-chain Layer 2 utilisation while maintaining security and operational excellence through professional interoperability management and advanced cross-chain strategies designed for institutional blockchain operations.

Layer 2 Security Excellence and Risk Management

Advanced Layer 2 security requires comprehensive risk management, including sophisticated threat assessment, advanced security monitoring, and systematic vulnerability management that protect Layer 2 operations while maintaining operational efficiency and user experience. Layer 2 security excellence includes implementation of advanced monitoring systems, sophisticated incident response procedures, and comprehensive security frameworks that ensure Layer 2 operations remain secure while enabling innovation and professional utilisation through security leadership and risk management excellence.

Professional Layer 2 risk management includes developing comprehensive security policies, sophisticated monitoring capabilities, and advanced threat detection systems to ensure Layer 2 operations maintain security standards while enabling strategic blockchain utilisation and operational optimisation. Security excellence requires comprehensive threat analysis, advanced security implementation, and sophisticated operational controls that enable secure Layer 2 utilisation while maintaining performance and user experience through professional security management and institutional-grade risk mitigation designed for enterprise Layer 2 operations and blockchain security leadership.

Future Layer 2 Innovation and Strategic Positioning

Layer 2 strategic positioning includes comprehensive trend analysis, sophisticated technology assessment, and advanced strategic planning that enable optimal positioning for evolving blockchain technology while maintaining competitive advantage and operational excellence. Strategic Layer 2 development incorporates advanced innovation monitoring, comprehensive opportunity assessment, and sophisticated planning frameworks that enable systematic Layer 2 evolution while managing technological uncertainty and competitive pressures through strategic excellence and professional blockchain development designed for Layer 2 leadership.

Future Layer 2 planning includes implementing comprehensive scenario analysis, sophisticated strategic modelling, and advanced contingency planning to enable optimal positioning for emerging blockchain technologies while maintaining current operational efficiency and strategic objectives. Professional strategic planning requires comprehensive technology intelligence, advanced analytical capabilities, and sophisticated decision-making frameworks that enable strategic Layer 2 positioning while managing uncertainty and technological evolution through strategic excellence and professional blockchain development optimised for long-term Layer 2 success and competitive advantage in the evolving blockchain ecosystem.

Cross-Chain Interoperability and Multi-Layer Strategies

Advanced Layer 2 utilisation requires an understanding of cross-chain interoperability protocols that enable seamless asset transfers and unified liquidity across different blockchain networks and scaling solutions. Cross-chain strategies include implementation of bridge technologies, atomic swap mechanisms, and sophisticated routing algorithms that optimise transaction costs while maintaining security and operational efficiency across multiple Layer 2 networks and blockchain ecosystems.

Multi-layer optimisation includes systematic evaluation of different Layer 2 solutions for specific use cases, implementation of dynamic routing strategies that select optimal networks based on transaction requirements, and development of comprehensive monitoring systems that track performance across multiple scaling solutions. Professional multi-layer strategies include automated optimisation systems, intelligent transaction routing, and sophisticated cost-benefit analysis that maximises efficiency while minimising operational complexity and security risks.

Institutional Adoption and Enterprise Integration

Enterprise Layer 2 adoption requires sophisticated infrastructure planning, comprehensive compliance frameworks, and advanced operational procedures that meet institutional requirements whilstleveraging scaling benefits for business applications. Institutional integration includes implementation of enterprise-grade custody solutions, comprehensive audit procedures, and sophisticated governance frameworks that ensure regulatory compliance while enabling efficient Layer 2 utilisation for business operations.

Enterprise strategies include development of custom Layer 2 implementations, integration with existing business systems, and creation of comprehensive training programs that enable organisational adoption of Layer 2 technologies. Professional enterprise adoption includes systematic risk assessment, comprehensive vendor evaluation, and strategic implementation planning that ensures successful Layer 2 integration while maintaining operational security and regulatory compliance for institutional blockchain adoption.

Developer Ecosystem and Innovation Opportunities

Layer 2 development requires an understanding of specialised programming frameworks, optimisation techniques, and innovative application architectures that leverage scaling benefits while maintaining security and decentralisation principles. Developer opportunities include creation of Layer 2-native applications, implementation of cross-layer protocols, and development of innovative user experiences that capitalise on improved transaction throughput and reduced costs.

Innovation strategies include participation in Layer 2 developer communities, implementation of experimental protocols, and creation of novel application architectures that demonstrate Layer 2 capabilities. Professional development includes systematic evaluation of development tools, implementation of best practices for Layer 2 optimisation, and creation of comprehensive testing frameworks that ensure application reliability and performance across different scaling solutions and network conditions.

Economic Models and Token Economics

Layer 2 economic models include sophisticated tokenomics designs, fee distribution mechanisms, and incentive structures that align network participants while ensuring sustainable operation and continued development. Economic optimisation includes understanding of fee markets, validator economics, and governance token mechanisms that influence Layer 2 network performance and long-term viability for users and developers.

Token economics analysis includes evaluation of different Layer 2 economic models, assessment of sustainability factors, and strategic positioning within Layer 2 ecosystems that provide governance participation and economic benefits. Professional economic analysis includes systematic evaluation of tokenomics designs, implementation of strategic token allocation strategies, and development of comprehensive economic modelling that optimises participation in Layer 2 networks while managing economic risks and maximising long-term value creation.

Security Considerations and Risk Management

Layer 2 security requires understanding of unique risk profiles, implementation of appropriate security measures, and development of comprehensive risk management frameworks that address Layer 2-specific vulnerabilities while maintaining operational efficiency. Security considerations include evaluation of bridge risks, assessment of validator security, and understanding of withdrawal mechanisms that impact asset safety and operational security.

Risk management includes implementation of diversification strategies across multiple Layer 2 networks, systematic monitoring of security developments, and development of comprehensive contingency plans that address potential security incidents. Professional security management includes regular security assessments, implementation of best practices for Layer 2 interaction, and creation of sophisticated monitoring systems that detect potential security threats while maintaining operational capabilities and asset protection across Layer 2 environments and scaling solutions.

Practical Implementation Strategies and Best Practices

Step-by-Step Layer 2 Onboarding Process

Successful Layer 2 adoption requires systematic implementation of onboarding procedures that address wallet configuration, bridge operations, and application integration while maintaining security and operational efficiency throughout the transition process. Professional onboarding encompasses comprehensive preparation, systematic testing with small amounts, and gradual scaling of Layer 2 operations that ensures smooth transition while minimising risks and operational disruptions during the adoption process.

The implementation process includes wallet setup for Layer 2 networks, understanding of bridge mechanisms and security considerations, systematic testing of applications and protocols, and development of operational procedures that ensure efficient Layer 2 utilisation while maintaining security standards. Advanced implementation strategies include multi-network diversification, comprehensive monitoring systems, and systematic optimisation of Layer 2 operations that maximise benefits while managing risks and operational complexity across different scaling solutions.

Cost optimisation and Transaction Management

Effective Layer 2 utilisation requires a sophisticated understanding of fee structures, transaction timing, and optimisation techniques that minimise costs while maintaining operational efficiency and user experience standards. Cost optimisation encompasses strategic timing of transactions, batch processing techniques, and systematic evaluation of different Layer 2 networks that provide optimal cost-benefit ratios for specific use cases and operational requirements.

Professional cost management includes implementation of automated optimisation systems, comprehensive monitoring of fee markets, and strategic positioning across multiple Layer 2 networks that provide operational flexibility and cost efficiency. Advanced optimisation techniques include sophisticated transaction batching, strategic network selection based on current conditions, and implementation of comprehensive cost tracking systems that enable data-driven optimisation of Layer 2 operations while maintaining performance and security standards.

Practical Implementation Guidelines

Layer 2 cryptocurrency solutions provide essential scaling infrastructure that reduces transaction costs while maintaining security through innovative consensus mechanisms. Effective Layer 2 utilisation requires understanding of bridge protocols, gas optimisation techniques, and cross-chain asset management strategies that maximise efficiency across multiple blockchain networks.

Step-by-Step Execution Framework

Strategic Layer 2 implementation begins with comprehensive planning that includes network selection, bridge configuration, and wallet setup procedures. Professional users establish clear protocols for asset bridging, transaction batching, and network switching schedules that maintain consistency while allowing flexibility for gas optimisation and cross-chain opportunities.

Security and Operational Procedures

Comprehensive Layer 2 security frameworks encompass multi-chain wallet management, bridge verification, and secure backup procedures that protect against both technical failures and cross-chain security breaches. Professional users implement comprehensive operational security protocols including bridge transaction verification, network validation systems, and emergency asset recovery plans.

Performance Tracking and optimisation

Systematic Layer 2 monitoring requires specialised tools and methodologies that account for multi-chain characteristics, including cross-network transaction tracking, gas fee optimisation, and bridge performance analysis. Regular performance evaluation enables strategy refinement and optimisation while maintaining alignment with long-term scaling objectives and cost management parameters.

Conclusion: Navigating the Layer 2 Ecosystem in 2025

Layer 2 scaling solutions have fundamentally transformed the Ethereum ecosystem, providing the infrastructure necessary for mainstream cryptocurrency adoption through dramatically reduced transaction costs and improved user experience. The maturation of rollup technology, the emergence of sophisticated cross-chain protocols, and the development of comprehensive developer tooling have created a robust foundation for the next generation of decentralised applications and financial services that can serve millions of users efficiently and cost-effectively.

The strategic selection of appropriate Layer 2 solutions requires careful consideration of technical requirements, economic factors, and long-term ecosystem positioning that aligns with specific use cases and user needs. Whether prioritising maximum decentralisation through zkSync, leveraging established liquidity on Arbitrum, or exploring innovative features on emerging networks, success in the Layer 2 ecosystem depends on understanding the unique characteristics and trade-offs of different scaling approaches while maintaining security and operational efficiency.

Professional implementation of Layer 2 strategies encompasses comprehensive risk assessment, systematic evaluation of network characteristics, and strategic positioning within multiple ecosystems that provide diversification benefits and operational flexibility. The continued evolution of Layer 2 technology, including improvements in interoperability, security, and user experience, ensures that early adopters and strategic implementers will benefit from enhanced capabilities and competitive advantages in the rapidly expanding decentralised finance landscape.

The future of Layer 2 scaling looks exceptionally promising, with ongoing developments in zero-knowledge technology, cross-chain interoperability, and institutional infrastructure creating new opportunities for innovation and growth. By understanding the fundamentals covered in this guide and staying informed about emerging developments, users can effectively leverage Layer 2 solutions to access the full potential of decentralised finance while managing costs and maintaining security in the evolving cryptocurrency ecosystem of 2025 and beyond.

As the Layer 2 ecosystem continues to mature, we can expect to see further consolidation around the most successful networks, increased standardization of cross-chain protocols, and enhanced integration with traditional financial systems that will drive mainstream adoption and institutional participation in decentralised finance applications.

Ready to explore Layer 2 solutions? Start with our MetaMask Layer 2 setup guide for wallet configuration, or check our DeFi protocols comparison to find the best Layer 2 applications.

Sources & References

Access Layer 2 Networks

Start using Layer 2 solutions with these platforms that support multiple networks. For detailed comparisons, see our Layer 2 comparison guide:

- Binance - Multi-Chain Support - Trade on Polygon, Arbitrum, and more

- MetaMask Wallet - Easy Layer 2 network switching

- Uniswap DEX Review - Available on multiple Layer 2s

Frequently Asked Questions

- Is Layer 2 safe?

- Generally, yes, but security depends on the implementation, upgrade keys, and maturity of the specific Layer 2 network. Established networks like Arbitrum and Optimism have been battle-tested with billions in TVL. Always research the specific Layer 2 you plan to use and start with small amounts.

- Can I use Layer 2 with my existing wallet?

- Yes. Popular wallets like MetaMask support Layer 2 networks such as Arbitrum and Optimism; many mobile wallets also support zkSync. You'll need to add the network to your wallet and bridge assets from the Ethereum mainnet.

- How long does it take to withdraw from Layer 2?

- This depends on the Layer 2 type. Zk-Rollups, such as zkSync, offer instant withdrawals, whereas Optimistic Rollups, including Arbitrum and Optimism, have a 7-day dispute period. You can use fast withdrawal services to get your funds immediately for a small fee.

- Which Layer 2 should I choose?

- For beginners, Arbitrum offers the best balance of security, cost, and ecosystem. If you're using Coinbase, Base provides seamless integration. For the lowest fees and instant finality, consider zkSync Era. Each network has its strengths depending on your specific needs.

- Can I earn yield on Layer 2?

- Yes! Layer 2 networks host many DeFi protocols offering yield opportunities. You can provide liquidity, stake tokens, or lend assets on platforms like Aave, Uniswap, and GMX. Always research the risks and start with amounts you can afford to lose.

Are Layer 2 tokens worth investing in?

Layer 2 tokens like ARB (Arbitrum) and OP (Optimism) represent governance rights in their respective networks. Their value depends on network adoption and usage. zkSync's ZK token is expected to launch in 2025. Consider these as part of a diversified crypto portfolio, not financial advice.

← Back to Crypto Investing Blog Index

Financial Disclaimer

This content is not financial advice. All information provided is for educational purposes only. Cryptocurrency investments carry significant investment risk, and past performance does not guarantee future results. Always do your own research and consult a qualified financial advisor before making investment decisions.